Is it impossible to have telematics tariffs without reaching the milestone of having relevant trip and claims data for a large reference group?

How do you start your telematics-based insurance product without pre-investing time and resources on this milestone? There is a way to launch data-enabled products without creating a new tariff from scratch or heavily adapting your existing Generalized Linear Models (GLM). Just by smartly using road accident statistics.

Insurance telematics is nothing new – it has been around for more than two decades. First patented by the major U.S. auto insurance company Progressive Auto Insurance in the late 90s, many insurers have followed and tried to innovate with telematics-based insurance products. Many of them failed to make use of the suddenly available data. There are several reasons why multiple insurance telematics programs failed, and not always because of the much-cited missing user acceptance. The technology’s potential was often misunderstood, and the integration of telematics-based insights into the product structure was complex or completely absent. The impact of behavioral and contextual metrics on pricing has been neglected.

It all started with quite simple Pay-As-You-Drive (PAYD) products, meaning telematics was, and is, only used to quantify distance or time traveled. While it’s comparably straightforward to implement, these insurance products do not take advantage of all data available, e.g., driving context and style, but consider high mileage solely as high exposure to claims. They do not help classify good and bad drivers based on their actual behavior or when and where they drive.

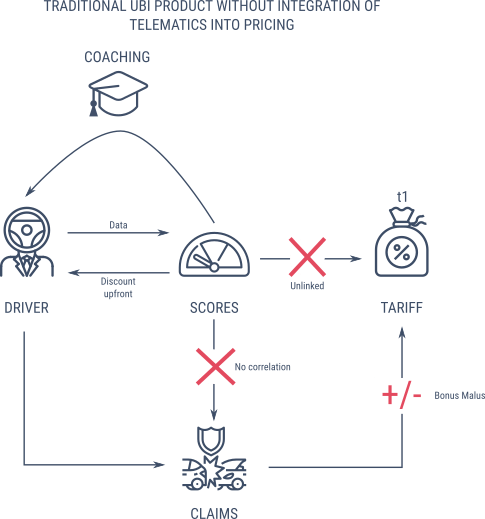

The next evolutionary step happened with the introduction of Pay-How-You-Drive (PHYD) models, analyzing driving behavior in terms of acceleration, braking, speeding, and cornering. Premiums are adjusted using simple scores, enabling separation between “good” and “bad” drivers. However, those scores have no proven link to any actual risk (i.e., claims or accident frequency and severity), preventing quantifying discounts or increases in premium based on existing tariffs safely. The most recent product evolution popped up with Manage-How-You-Drive (MHYD), combining proactive customer engagement through driver-facing feedback with driving style and dynamic rate adjustment.

History does not stop here as the insurance industry tries to innovate constantly. In recent years, the adoption rates of telematics-based insurance products have grown continuously, and it’s forecasted to grow even more at a CAGR of 25.1% from 2020 to 2027.

In the past, the insurance industry has spent a lot of energy on deploying telematics-based products without integrating telematics-based insights into the tariff. Why that? To integrate telematics data into pricing, actuaries would need to correlate, for a given group of representative customers, telematics-based metrics to claims characteristics. Both claims and telematics data need to be available for that group.

This would allow an actuarial team to integrate telematics-based variable into their Generalized Linear Models (GLM) with concrete explanatory variables from which frequency (in terms of telematics-based events) and severity (in terms of claim cost) are duly modeled, being able to use each of those variables for different risks coverages and premium calculation. However, not all the insurers having deployed telematics could reach that point, because of many reasons: (i) volumes in terms of telematics-based customers have not been huge, (ii) telematics initiatives mainly focused on marketing-oriented “digital” products, giving upfront discounts, (iii) the level of insights and metrics on the telematics data might be limited to third-party scores on acceleration, braking, and cornering, which for sure will not have a high explanatory power once correlating to claims. Integrating telematics not only in the frontend but also in pricing and using it for price modification of existing products is the real challenge.

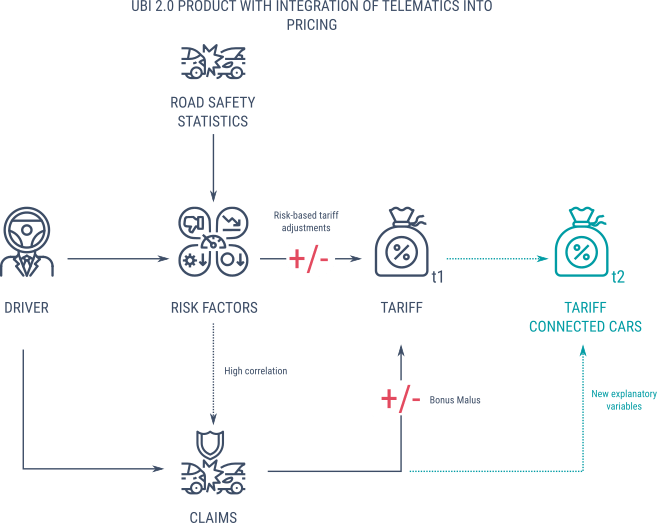

But, what other data instead of claims could be used to measure risk from drivers objectively? Road accident statistics are undoubtedly the best proxy for claims and give insights into accident causes. With publicly available data from, for example, the European Commission or the National Highway Traffic Safety Administration, one can derive models and factors.

By going beyond driving dynamics and computing risk metrics based on contextual and behavioral data, we can cross-correlate to road accident statistics and build models for both frequency and severity. The key is on explaining with telematics-based metrics concrete risk factors for which road accident statistics are available for many road contexts (urban, rural, or freeway driving). Thanks to a patented approach, telematics-based metrics can finally be integrated into pricing as a simple multiplicative factor, with a proven link to risk. We used a reference set to build the pricing tool based on an extensive and representative reference set with more than 400 drivers tracked at least for one month each, counting over 6 million kilometers traveled in Europe.

Translating a driver’s measured risk exposure into a single multiplicative factor is what our tool does. It can modulate up and down the calculated premium of an existing insurance product. To state it really explicitly: there is no need to create a new tariff, but our approach offers the unique opportunity to improve existing tariffs with one single added factor in a fully risk-oriented approach. The insurer can adjust telematics’ influence on its pricing, meaning setting the range of discounts and price increases. Testing and creating different sets of multipliers can be done in the pricing simulator tool in a safe environment. The insurer can smoothly introduce telematics into its existing tariffs and give data-driven factors step by step a more significant influence as trust is being built over time.

The tool’s power lies in its versatility for a wide range of telematics insurance products, ranging from simple PAYD, Pay-Where-You-Drive (PWYD), to the most advanced PHYD with advanced risk metrics based on context and behavior. It is also possible to model using telematics metrics, tariff multipliers for specific coverages like windshield or animal crossing protections.

For a given coverage to be modeled, several telematics metrics will be selected, and multipliers will be calculated by computing the number of potential accidents explained by a given user and its position within a global reference population.

To give some examples, a PWYD product could be modeled using the following risk factors (and their associated telematics metrics):

Also, a simple windshield protection coverage could be modeled using:

With this new technology, several opportunities arise:

The integration of telematics-based pricing tools opens the door for building insurance products beyond traditional car insurance, with innovative features for situational or on-demand insurance coverage. Think about the endless opportunities of cross-selling and upselling non-motor insurance products when and where they are needed. With vehicles becoming more and more connected, the necessity of building a data lake and preparing your tariffication models for the era of autonomous vehicles is crucial. Investing in integrating telematics data into pricing models will empower you to compete with automotive players entering the insurance market.

Key takeaway: Integrating telematics data into insurance pricing has always been a hassle. Adding just one single and risk-oriented multiplicative factor to a base insurance premium is a game-changer. More than that, introducing telematics-based products to the market without the need to have simultaneous knowledge of claims and telematics data for your reference groups, but instead relying on objective accident-based risk scores lets insurers design safely competitive products.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Test drive our API Suite for 30 days!

Tell us a bit about yourself, and we’ll get in touch with you in no time.