Further, Faster, Cheaper: How Data Analytics Helps Mobility Businesses Go an Extra Mile

A practical guide for mobility businesses on how to make the most out of their data and build data-centric solutions. … Read More

Traditionally, connected insurance uses data from IoT telematics devices to tailor premiums based on driving insights. But today, new ways of building effective connected insurance programs have come into play, like driver safety rewards programs, sustainability and green benefit programs, personalized recommendations, or cross-selling insurance products. To tap into these, insurers must deploy appropriate data collection technology. But what is ‘appropriate’ in this context?

Since its valuation of $739.30 billion in 2019, the global auto insurance market has been on the rise. By 2028, it is estimated to reach $1,620.2 billion, growing at an annual rate of 8.8 percent. This growth presents enlightened insurers with the opportunity to increase their revenue and market share, with the implementation of connected insurance being one of the innovative strategies to achieve this. But what do insurers need to take advantage of the opportunities it presents?

By leveraging telematics data, innovation-driven insurers can launch various programs that will help them reduce costs, increase customer engagement, and build loyalty in the long run. These include, but are not limited to:

Data collection is no longer new to the insurance sector, but the methods by which telematics devices capture data for auto insurance are constantly evolving. As innovation continues, some techniques become obsolete while others take their place. Still, for now, several data collection methods prevail (to get more detailed information about these and other devices, head to this post about selecting the right telematics devices).

These devices, used in telematics for many years, come in different forms and shapes, some plugging into a vehicle’s OBD II, others enabling Bluetooth connectivity. Insurers can use them to track how a person drives or how much they drive and offer them more realistic (or fair) prices. The accuracy of their readings is very high. Besides, permanent mounting eliminates the risks of forgetting them or collecting trip data while riding in the passenger’s seat. Additionally, many fleets already use them, which reduces the need for investing in new devices. Traditionally, dongles and black boxes collected location data, but more advanced solutions can also detect extreme driving maneuvers and help identify the cause of accidents and crashes.

As good as this all may sound, there are several cons to using traditional telematics devices. They usually don’t come cheaply (the prices range from 50-200 Euro per item), and there’s an extra cost of data connectivity involved (monthly). Also, in the case of GPS trackers, hard-wiring them in the car usually requires help from a technical expert. On top of that, locations are often transmitted at a lower frequency than in mobile apps, which limits the capacity to detect some driving situations (anticipation of stop signs and give way signs, for example). Then, there’s the question of drivers’ and users’ resistance to installing a tracker that monitors their every move permanently and cannot be easily switched off.

The many uses of an ODB dongle

Example Device: TELTONIKA FMC001 Tracker OBD plug and play LTE / GNSS / BLE

https://teltonika-gps.com/fr/product/fmc001/

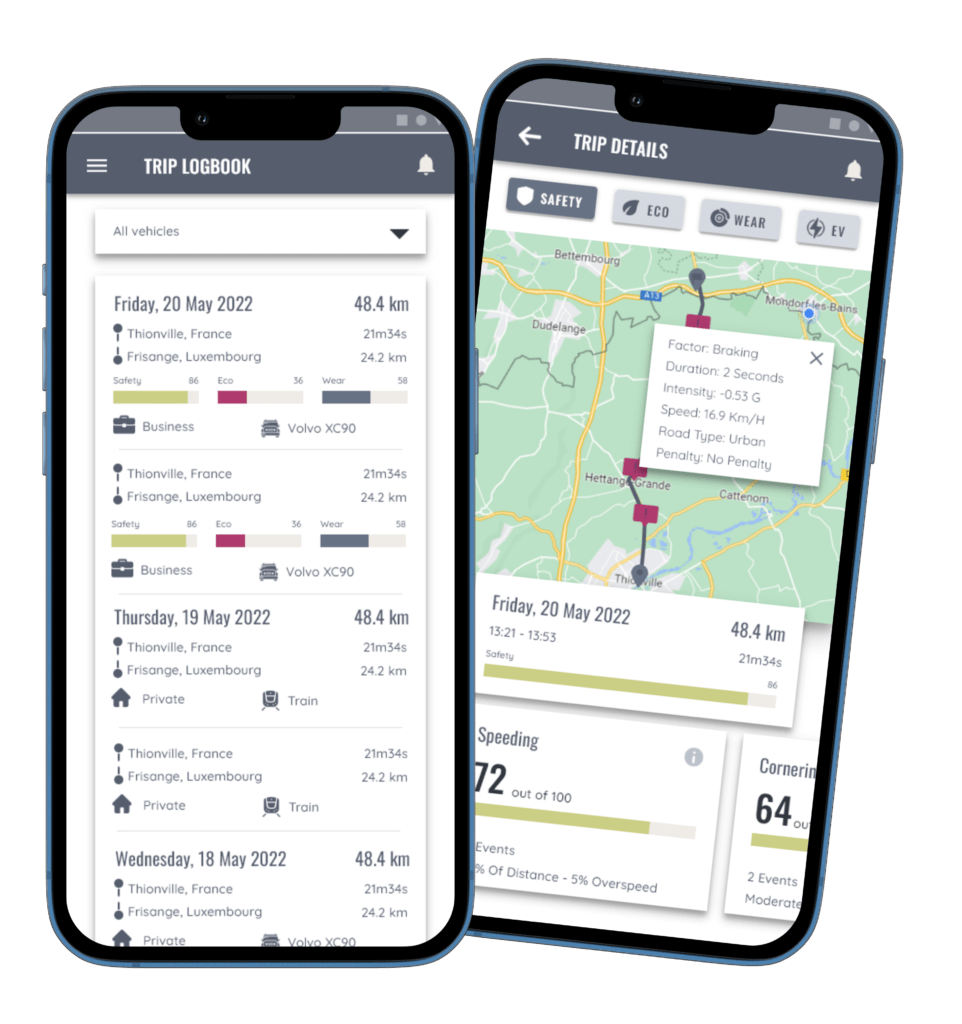

Smartphones come with various sensors that allow insurers to collect mobility data. This data then feeds into mobile apps providing unique insights into driver behaviors and safety. While, in principle, these apps are similar, some variations exist. For example, certain driver applications detect trips automatically through the phone’s sensors, while others need the driver to declare the start and end of the trip.

The agility and simplicity of these solutions (download an app, set the permissions, and you’re ready to go!) make them an increasingly popular choice among insurers and customers. In addition, they remove the necessity to pay for devices—both up-front for the units and continually for the connectivity. Also, as mentioned before, they transmit data at higher frequencies, which helps investigate the driver maneuvers with high precision. At the same time, most drivers are familiar with mobile apps, which simplifies onboarding and helps keep them engaged through coaching, challenges, and leaderboards.

While apps are a great tool to run connected insurance programs focused on loyalty and rewards, they also have some shortcomings. For example, one of the biggest challenges for insurers is ensuring the phone is with the driver and verifying that a user is behind the steering wheel and not in the passenger’s seat. This makes mobile-based solutions not ideal for pay-as-you-drive programs for which having the exact distance driven is essential.

OEM connected car data platforms use data from sources like in-car infotainment systems, vehicle electronic control units, and in-vehicle networks to provide valuable and usable insights. These insights inform modern mobility solutions and can be used across industries, including auto insurance, car maintenance, fleet management, targeted advertising, and many more.

In OEM platforms, data comes from the onboard computer and therefore offers precise information about trouble codes, car diagnostics, ADAS (safety systems), fuel levels, usage of the car, and more, which can be used to infer a driver’s safety. A famous example is Tesla insurance, available in several US states. It offers premiums that depend on the vehicle, selected coverage, the customer’s address, how much they drive, and the vehicle’s monthly safety score built using connected car data.

Because of the immense opportunities, the solution offers to the mobility industry, its widespread adoption is not a matter of whether, but when. For example, GSMA predicts that by 2025, connected cars will represent over 5% of all connected devices. Meanwhile, Ericsson claims that by 2027, half of all mobile subscriptions will be for the 5G network. Certainly, at some point, every car will be connected to the outside world through a cellular network, which accounts for the increasing popularity of OEM connected car data platforms and the need to start building innovative products in insurance leveraging its technology.

At the same time, while connected car data penetration is growing fast and holds great potential, there are still limitations and challenges to address today and in the midterm future. Even though most car models manufactured and distributed in the European market after 2017 come with connected car platforms, globally, most vehicles still aren’t equipped with this technology. Besides, the data access cost is still relatively high and inconsistent across brands, making it difficult to manage. These two points mean that launching a connected car data-enabled insurance today is only possible for a limited group of users. Furthermore, as in the case of dongles and GPS trackers, the location data is not available at high frequencies, which limits the capacity to detect certain driving behaviors which are possible using mobile phone alternatives. Finally, another point to consider is that when it comes to private use insurance products, for accessing each vehicle’s data, specific permission must be requested from the individual user, which makes implementation not so straightforward.

The transformation in the automotive insurance market is noticeable—and it owes much to innovations in telematics devices for data collection, such as smartphones, OBD devices, wireless technology, etc.

The choice is broad, and it depends on a variety of factors, such as:

These factors, together, determine the level of complexity of the program to be run and the most suitable and customary device to select.

Connected insurance programs can help insurers position themselves as industry leaders. But to achieve the most complex data objectives, they must choose solutions that, apart from matching their needs and wallets, will be readily adopted by their customers. Considering the available options and scenarios, that choice may be tough. Fortunately, in case of any doubts, you can always rely on our expertise.

A practical guide for mobility businesses on how to make the most out of their data and build data-centric solutions. … Read More

Remember the early days of the pandemic? Cities became ghost towns, and public spaces were no longer public, as everyone locked in to avoid getting infected. COVID has affected most aspects of our lives, and mobility was no different. With work and school going remote and traveling severely limited or outright prohibited, roads emptied. As a result, traffic remained light—even though driving was the only way to get a little taste of the outside world for many. … Read More

The invention of the gas-powered car by Carl Benz in 1885 wasn’t just another step in the history of mobility—this time, humanity has made a real leap forward. By making transportation more efficient and accessible, internal combustion engine (ICE) vehicles have affected all industries in one way or another. Over time, we started to rely on them so heavily that we now design our routines, lifestyles, and even entire cities around them.

But no king rules forever. Fast-forward to today, and after almost 130 years, the reign of combustion engine cars is slowly but surely coming to an end. A new contender is on the rise—electric vehicles (EVs). … Read More

According to various sources, a new car loses 9–11% of its value the moment you drive off the dealer’s lot. Over 2-3 years, its price may diminish by more than a half! Although it might seem that the situation is helpless, data science can provide a cure. Learn how applying the right algorithms on telematics data can help you protect and boost the value of your vehicles.

… Read More

A practical guide for car insurers to build customer-engaging products, expand services, and boost profitability in the post-pandemic times.

… Read More

Picture this. You’re driving back home after a long day of hard work. Exhausted from a series of back-to-back calls, starving despite that quick, half-eaten sandwich you rushed through between one virtual meeting and another. Dying to finally get well-deserved rest.

But just then, a sharp squeal comes from under the hood. Is it an issue with brakes or a loose or worn fan belt? Maybe the steering system went down?

Either way, your dreams of a good evening’s rest are now ruined, and you’re up for towing or an unplanned inspection. Both of which are going to cost you dearly.

Now, what if all of that time and hassle could have been avoided?

… Read More

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Test drive our API Suite for 30 days!

Tell us a bit about yourself, and we’ll get in touch with you in no time.