Behavioral risk factors are concerned with how drivers’ behavior affects safety on the road. Speeding, harsh braking, or swerving, for instance, are all associated with road accidents. But even when drivers follow road rules to the letter, fatigue and phone distraction can still be just as dangerous as recklessness. All that and other behavioral data can be tracked using telematics devices and should be considered alongside contextual data in risk analysis.

Context matters…

With contextual and behavioral data in place, it’s time to see what insights we can extract and how we can turn them into action.

The key to accurate predictions lies in finding patterns. When it comes to contextual data, the perfect use case is identifying accident hotspots, i.e., places where accidents occur more frequently than others due to poor road conditions, misguiding signage, or specific road characteristics (e.g., sharp curves or steep slopes). Another risk factor that occurs in patterns, depending on the hour and day of the week, is traffic intensity.

The knowledge of traffic and accident rate patterns allows drivers to avoid hotspots and roads that are often dangerously busy. This approach helps reduce the risk, especially when you factor in other risks, such as weather. For instance, if heavy rain is expected, drivers may consider choosing a different route to steer clear of a particularly unsafe, crowded motorway exit when visibility and traction are limited.

… but driver behavior is just as important

However, contextual factors are often out of our control and hence difficult to act on. Weather is the most glaring example, but other factors, like road conditions and infrastructure, are also difficult to manage for drivers and fleet managers. Technically, they could take a rerouting to avoid dangerous spots, but in reality, it’s not always possible or efficient.

What we can do is track how drivers react to these external circumstances and use that knowledge to change their dangerous road habits.

Let’s get back to our example. Taking that dreaded motorway exit may be unavoidable, despite the rain and heavy traffic. But instead of just hoping for the best, behavioral data allows drivers and mobility businesses to take an active approach. We can predict how a particular driver will react to external risk factors based on historical records.

Will they maintain high speed despite low visibility? Can they stay focused enough with so many vehicles around? Did they have any near-misses in similar road situations in the past? Knowing the answers to these questions makes risk predictions more accurate and actionable, allowing drivers to adjust their driving style accordingly.

By diving deep into data, mobility analysts can find links between various contextual and behavioral risk factors. Some conclusions can be surprising. For example, good weather conditions (daylight, low traffic) may encourage drivers to step on the gas, paradoxically increasing the likelihood of an accident. Similarly, despite a low average vehicle speed, congestion and traffic jams can be extremely conducive to crashes, largely due to how irritating they are. Combine that with a dense concentration of drivers, and you have a recipe for distraction, road rage, and tailgating.

These not-so-obvious insights prove that combining contextual and behavioral data is a powerful weapon in the fight against road hazards. But aside from increasing traffic safety, businesses can use the insights provided by DSaaS solutions to enhance their services, develop new, data-informed products, and drive profits. One industry that has successfully done that is insurance.

Aligning insurance pricing with road risk assessment

Traditionally, insurance providers relied on static risk factors such as vehicle characteristics (e.g., brand, model, condition), driver demographics (e.g., age, place of residence), and claims history for developing pricing models. While this used to be the industry standard, policy rates based on static data failed to reflect one crucial thing: how the car was used.

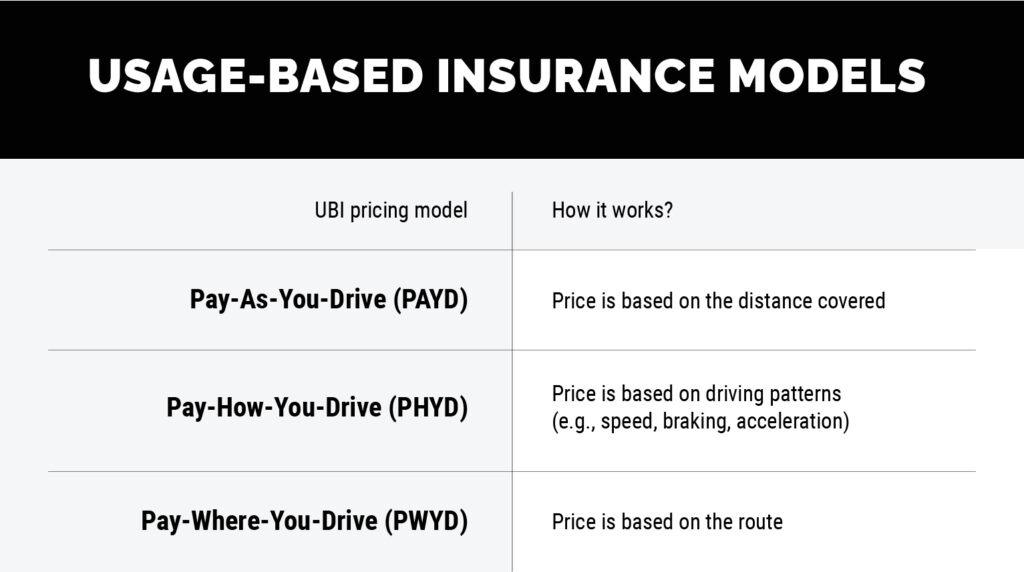

That changed when insurance providers started to adopt telematics. The ability to measure dynamic factors such as distance covered, acceleration, or location allowed insurers to take a different approach with usage-based insurance (UBI) and new pricing models.