Customer Interface

OUR OFFER

Launch innovative insurance ideas, powered by the right combination of digital technology, telematics, and accurate driver safety analytics. Accelerate the growth of your business by attracting, engaging, and delighting your customers.

ATTRACT & CONVERT

Provide personalized tariffs to the users from the app, in sync with your website tarifficator. Your users will have the chance to submit their details from the app, get the relevant tariffs, and begin their digital journey. Immediacy, convenience, and excellent customer experience!

No conversion?

Ask new users to share their driving data for a limited number of days and provide a tariff discount based on their safety profile. Get suggestions on how to adjust your tariff based on thresholds you select. Improve the conversion rate of new users, grow your safe drivers‘ pool, and welcome new clients to your Connected Insurance community.

ENGAGE

Engage with your customers and coach them to improve their safety profile. Provide meaningful hints on how to improve their driving style to become better and safer drivers. Make safe driving a fun thing with customizable challenges and badges for each and every trip for immediate feedback!

DELIGHT

Sponsor a connected Rewards & Loyalty program to delight your users. Reward their behavior with impactful benefits, and generate your mobility profiles data lake.

Give your customers a different reason to choose your product over the competition.

GROW

Let the user digitally submit claims and get rapid and accurate FNOL, request roadside assistance, or ask for support from one of your representatives to work through the required paperwork. Centralize your client experience in your App, go fully digital, and collect labeled data of your claims to begin exploiting it!

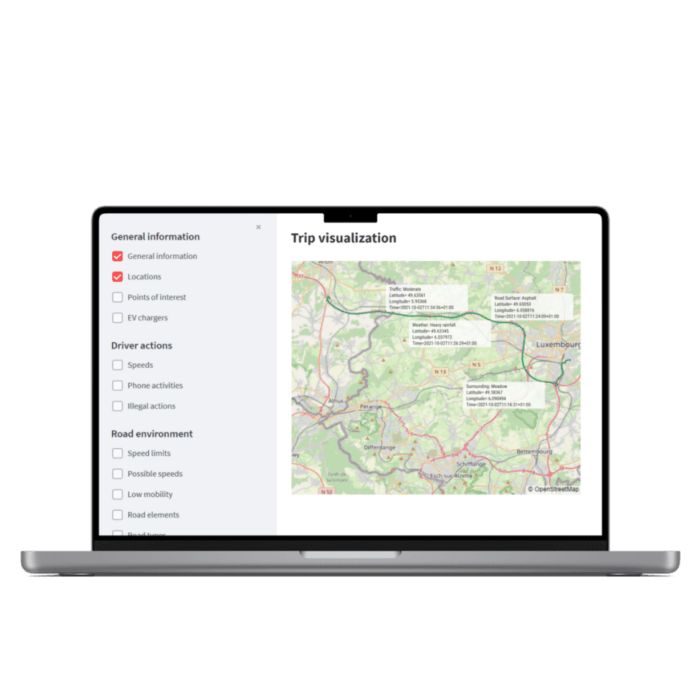

Accurate data collection, rich driver Analytics, insightful dashboards

Our analytics models allow you to process trip data from your users, understand their driving safety profile, and offer rewards based on exposure to risk. We offer a technology suite to collect trip data through smartphones, IoT devices, and connected car data, engage and coach drivers, manage the program, and exploit mobility data to grow your business.

RELATED ARTICLES

A practical guide for car insurers to build customer-engaging products, expand services, and boost profitability in the post-pandemic times. … Read More

Are you ready for a new era of device-free, data-driven Fleet Solutions? Watch our free webinar to look at the future of #fleetOptimization powered by Connected Car Data. Together with our partner High Mobility, we'll be looking at the new possibilities that open up thanks to Connected Car Data and how these can empower innovation across the fleet industry. We'll cover: “What use cases do OEM-connected car data platforms enable?”, “What are its current limitations, and how to tackle them?”, “What to expect of the midterm future?”, and “How connected car data can be leveraged to innovate in the fleet industry?”, among others. Register now and join the discussion. … Read More

Traditionally, connected insurance uses data from IoT telematics devices to tailor premiums based on driving insights. But today, new ways of building effective connected insurance programs have come into play, like driver safety rewards programs, sustainability and green benefit programs, personalized recommendations, or cross-selling insurance products. To tap into these, insurers must deploy appropriate data collection technology. But what is ‘appropriate’ in this context? … Read More

There are many immediate benefits to launching a connected insurance program—from higher customer engagement and loyalty with rewards, coaching, and reduced claims, to new revenue streams thanks to innovative insurance products. But the jackpot, truly, lies in the long-term vision. To maintain profitability in the long haul, motor insurance companies should already think two steps ahead, reconsidering their data approach today to reap benefits tomorrow. … Read More

The car insurance industry has seen many conversations around the pivotal role of digital technologies, product innovation, and customer-centricity as market differentiators. With these concepts, new terms have emerged to reflect the cutting-edge technologies and the upgraded ways of doing business. Understanding what they mean, how they differ, and what opportunities and constraints they entail, is essential to getting ahead of competitors. … Read More

“Any sufficiently advanced technology is indistinguishable from magic.” The best-known technology law formulated by Sir Arthur C. Clark in the ’60s still holds today, when insurance companies can use connected telematics solutions as a competitive lever to improve profitability and expand their customer base. To better understand how that works, we’ll take a step back and examine how telematics has changed over time. … Read More

Amid the accelerating economic recovery, the competition in the motor insurance market is intensifying. To make up for the losses sustained during the pandemic, insurers are unlikely to cut down premiums to incentivize customers. Instead, they will look for other methods to attract and keep them. But how to put new life into the hackneyed world of bonus rewards and privilege points? You’ll find some ideas in this article. … Read More

Reserve your personalized demo now and we’ll be happy to discuss the best solutions for you!

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Discover our new guide for car insurers to build customer-engaging products, expand services, and boost profitability in the post-pandemic times.

Test drive our API Suite for 30 days!

Tell us a bit about yourself, and we’ll get in touch with you in no time.