Creating a Connected Insurance Program That Finally Works

A practical guide for car insurers to build customer-engaging products, expand services, and boost profitability in the post-pandemic times

DOWNLOAD THE GUIDE

A practical guide for car insurers to build customer-engaging products, expand services, and boost profitability in the post-pandemic times

DOWNLOAD THE GUIDE

A practical guide for car insurers to build customer-engaging products, expand services, and boost profitability in the post-pandemic times

DOWNLOAD THE GUIDE

In the car insurance industry, challenges are the only constant. Skill shortages, economic slowdown, and frequent legislative changes give insurers sleepless nights as if the fierce competition wasn’t enough of a headache. The US insurance market spans nearly 6,000 providers, while European insurance companies jointly employ over 920 000 people working for more than 7,000 providers. How to build and maintain profitability in the sea of competitors, sometimes much bigger and more advanced technologically?

This question becomes even more pertinent if we consider that customer acquisition cost has been traditionally higher in insurance than in other industries, ranging between $487 and $900 for each new customer. Thus, attracting a new client is a sizeable investment, which may quickly turn into a loss if you fail to deliver a distinctive value and keep your newly-acquired customer from defecting to the competition.

And yeah, we haven’t even mentioned the ripple effect of the pandemic on motor insurance providers. Lockdowns and remote work led to a notable decrease in claims and payouts, resulting in a record fall in premium rates. For instance, in the USA, premiums lowered for the first time in a decade in 2021 (by 1.7%). Meanwhile, in the UK, the cost of premiums hit a 6-year low, according to ABI’s Motor Insurance Tracker.

To make things worse, the dramatic reduction in driving during the pandemic, soaring gas prices, and slowed new car production (due to global supply chain disruptions) have been eating into auto insurers’ revenues. In the context of the high competition in the motor insurance market, these factors make it increasingly difficult for motor insurance providers to warrant reasonable prices while sustaining profit. Lastly, negative trends like distracted driving or worsening crash severity also affect car insurers’ profitability.

Insurers appreciate that many households are facing a cost-of-living squeeze with rising household bills as costs rise in other areas of the economy. So they will do all they can to ensure competitively priced motor insurance, in the face of the variety of cost pressures.

Laura Hughes

ABI’s Manager, General Insurance

[Source: ABI]

All these challenges amplify as they converge with the rising power of consumers from globalization and digitization. Namely, today’s consumers are much more aware and participatory in their buying decisions, entertaining the liberty to choose between various channels of interaction, product delivery models, and the range of purchased services.

The growing field of insurtech has also played a role with many legacy firms like Nationwide partnering with startups to add to their digital suite.

Beth Riczko

President of property and casualty personal lines, Nationwide

[Source: Forbes]

Numerous consumer surveys conducted within the last two years confirm that. For instance, EY reports an enhanced interest in usage-based insurance (UBI) due to forced lockdowns globally. Paying high premiums for insurance, they couldn’t convince many people to try usage-based plans. In late 2020, 68% of them expressed strong or moderate interest in UBI, where they pay a subscription fee plus a premium based on the miles driven.

PWC contributes other significant findings in its COVID-19 insurance buyer survey, revealing that 41% of consumers are likely or more likely to switch insurance providers due to a lack of digital capabilities. Add to that the conclusions from the AIB data insurance report: nearly half of the car insurance customers are comfortable with their insurer collecting information about their driving habits, while 59% would prefer to pay for insurance based on their exact risk, and you’ll get the full picture of consumer wants: more personalization, more flexibility, more digital!

Thankfully, unlike geopolitical climate or international relations dictating energy, oil, and fuel prices, challenges involving human factors can be—to some extent—managed. And connected car insurance solutions provide the way to achieve that.

Chapter One

Connected vehicle insurance uses data analytics technologies and telematics devices for creating data-based insurance products and services. The analytics software underlying modern insurance solutions provides driver and risk insights based on data collected by telematics (“the technology of sending, receiving and storing information relating to remote objects via telecommunication devices”). Insurers can then use these insights to modulate insurance premiums or reward safer drivers via personalized discounts and benefits, for example.

The concept of connected car insurance truly evolved when GPS arrived, enabling relaying exact vehicle coordinates to the emergency services in case of an accident. Still, the forerunners of telematics emerged back in the 1980s. When the Internet of Things (IoT) permeated the mainstream, more sophisticated telematics devices developed to read the car’s position and speed, detect braking or accelerating patterns, and track component wear.

Introduction of e-call technology in new vehicles

Telematics solutions enable remote diagnostics for vehicles for the very first time

Network devices are integrated and enable vehicle health reporting or navigation

High speed telematics becomes standard

Key milestones in telematics development over the last 30 years

More recent telematics solutions are increasingly focusing on mitigating or eliminating human error. They provide in-depth insights into driving patterns, collecting dozens of parameters to recreate a particular driver’s behavior given specific weather and traffic conditions, time, and topology.

The current AI-based telematics solutions still use the ‘traditional’ ABC metrics. However, they supplement them with driver behavior analytics (complying or violating traffic laws, taking a break when tired, speeding offenses, etc.), augmented with the context of driving (road conditions, traffic, weather). Additionally, they calculate the total risk by considering the frequency and magnitude of risky events. Lastly, the final risk score is provided, based on which insurers seeking market differentiation can build their innovative products and services.

There are numerous benefits to using such technology, from increased operating efficiency to more informed, faster business decisions. But the main leverage that advanced mobility suites offer to insurers is a truly personalized customer experience.

Telematics helps insurers build a delightful customer experience from start to finish

The groundbreaking case of using telematics in insurance was by a US market leader, Progressive Insurance. The company already experimented with the technology in the mid-1990s, patenting a usage-based insurance product.

In Europe, Generali was one of the first insurers to tap the potential of telematics. The industry forerunner has been using data analytics platforms to tailor products to customers for over a decade.

But these pioneering projects would not be possible were it not for the underlying technologies, such as GPS, the Internet, and finally, 5G:

The US Department of Defense for military and intelligence applications introduced GPS technology. Also invented was Advanced Research Projects Agency Network (ARPANET), which was the first network to use the Internet Protocol Suite.

A Greek inventor and scientist, Theodore G. Paraskevakos, laid down the concept of machine-to-machine (M2M) technology, allowing machines to talk to each other directly.

The term ‘Telematics’ was coined in a technology development report to the French prime minister.

Researchers began experimenting with vehicle telematics to improve road safety and reduce environmental impact.

GPS technologies premiered on the consumer market, reaching US civilians. But it wasn’t until the early 2000s when GPS-based navigation flooded global markets.

Advancements in the cloud and M2M technologies enabled superfast and precise tracking of GPS data and other sensor parameters accessible for real-time reporting.

The first SIM cards are integrated into new cars, allowing the drivers to access phone functions from the vehicle’s cockpit and enabling the first congestion forecasting systems.

Unprecedented innovation in IoT devices, data intelligence, and 5G (or even 6G) networks are gradually enabling level 3-5 automated cars. Once we get there, the shift will cause a massive disruption to the vehicle insurance market.

Today’s telematics systems not only derive intelligence from multiple sources but often provide AI-driven prediction tools. Insurers can use them, as an example, to calculate the probability of a driver getting involved in road accidents or learn more about the users’ mobility habits. The scenarios are endless, and the insurance provider’s imagination only limits them.

In the future, information will be exchanged between vehicles and their surroundings more quickly than before, making the possibilities almost unlimited. For example, vehicles could communicate directly with the auto repair shop, download vehicle software updates via over-the-air updates, or provide drivers with traffic information before they even start driving.

Johann Hiebl

Head of the Continental Infotainment & Connectivity business unit

[Source: Continental]

Chapter Two

Telematics has made great strides since the introduction of GPS in the 1960s, seeing some unprecedented innovations, especially in the last years. While smartphone-based telematics solutions are the most common today (requiring no hardware installation inside the vehicle), a few different types of telematic devices are available, powering modern auto insurance products:

Simple devices tracking the basic parameters like braking, acceleration, and cornering. They plug into the auxiliary power outlet in the vehicle or to the 12V car cigarette lighter socket.

Contracted to OBD, these devices plug into most cars’ OBD II ports under the dashboards. Slightly more sophisticated than plug-in telematics, they provide information about the car’s fuel economy, location, CO2 emissions, and some basic data about the driver’s behavior.

This is a fixed box wired into the vehicle, delivering precise data on car identification, mileage, and trips. Blackbox devices are reliable, tamper-proof, and accurate, but they require installation and maintenance by professionals and can be quite expensive.

Modern dash cameras come with AI software that continuously analyzes road conditions and records driver behavior. They are typically mounted on the car’s windshield, complementing a GPS tracker by providing visual evidence. There are many benefits of installing them in the vehicle, both for drivers and insurance providers, from having a record of accidents and collisions, through faster case clearing, to protecting the vehicle from theft or breaking in.

Smartphone apps are an efficient and inexpensive way to track various information related to drivers and their trips. They don’t require an installation, receiving data from in-car sensors and displaying them through a user-friendly app interface. The output can be used to build driving behavior indicators (such as scores, suggestions, risk events, etc.) and assess risks related to safety, eco-driving, and distracted driving.

Original car manufacturer’s data platforms (OEMs) allow users to see and manage all vehicle and equipment data integrated in one dashboard. They display the information collected from factory-installed devices; hence they don’t require any extra effort on the driver’s side. On the other hand, since they are fixed, the driver (and insurer) only gets access to the data and configurations available by default. Managing the safety of different cars and models may therefore be very demanding and involve handling several software platforms. Nevertheless, connected car platforms seem to be the future of telematics as the next-generation cars roll out on the streets. According to some industry reports, by 2024, as many as 84% of vehicles may have OEMs embedded.

Chapter Three

About 400 fatal crashes happen in America yearly due to texting and driving. That number increases to over 30,000 when we consider distracted driving. In the EU, an estimated 19,800 people died in road accidents in 2021, up over a thousand compared to 2020.

Tapping into telematics data can prove instrumental in reducing the number of crashes and collisions caused by exhaustion, distraction, or hurry. How? For instance, smart devices plugged into an analytics engine can detect manipulating a phone while driving, or a dashcam can help protect drivers from the impacts of dizziness and fatigue.

Several aspects make a strong case for adopting driver behavior analytics to offer data-informed connected car insurance that provides coverage or benefits suited to an individual’s driving style, road behavior, road, weather, and traffic conditions. Let’s review some of them.

While Americans drove less in 2020 due to the pandemic, NHTSA’s early estimates show that 38,680 people died in motor vehicle traffic crashes—the largest projected number of fatalities since 2007. That is an increase of about 7.2 percent compared to the 36,096 deaths reported in 2019.

Preliminary data from the Federal Highway Administration (FHWA) shows vehicle miles traveled (VMT) in 2020 decreased by about 430.2 billion miles, or about a 13.2-percent decrease. Meanwhile, the fatality rate for 2020 was 1.37 per 100 million VMT, up from 1.11 deaths per 100 million VMT in 2019.

Even though NHTSA’s analysis is specific to the United States, research in other countries reveals similar trends. When it comes to the main behaviors behind these numbers, they are also very much consistent globally and include impaired driving, excessive speeding, and failure to wear a seat belt.

Prolonged lockdowns, shift to remote workplaces, online schooling; pandemic has reshaped driver behavior in a way reflected in road accident statistics. For instance, a recent survey asked 2,000 American drivers to describe how the pandemic has impacted their driving habits. It occurred that 46 percent of them were on the roads less during the pandemic. Of these respondents, 37 percent went so far as to say they forgot how to drive. Nearly half (47 percent) of all respondents shared they hadn’t driven more than 50 miles per month since the pandemic began.

In another survey, The Zebra has found some remarkable insights about distracted driving, usually associated mainly with talking on the phone behind the wheel. However, the main activity that 52.5 percent of people engage in while on the road is eating, followed by putting on or changing clothing while driving (reported by 26.8 percent of respondents). Texting takes the third spot, with 23.6 percent of drivers guilty of the deed. Interestingly, many drivers also admit to applying makeup or deodorant as they drive (15.2 percent) and engaging in sexual activity (14.9 percent).

Chapter Four

According to varying sources, it costs about 7-9 times more for an insurer to attract a new client than to retain one. Likewise, a study by IBM indicates that the cost of acquiring clients in the insurance industry is continuously rising: it has increased from 15.8 percent of gross written premium (GWP) in 2018 to 17.9 percent in 2022. Therefore, it’s highly surprising that many insurance companies actively invest in customer acquisition rather than retaining existing insureds, even though they lose about 16 percent of the customer base annually.

Yet, with all the new data available, personalized insurance can be a remedy to these woes. By offering data-driven products and services to existing customers, car insurers provide them with a chance to lower premiums as they drive more efficiently. But personalized insurance pricing is not the only benefit of leveraging connected car data to keep customers loyal. Insurers can use driver insights in many applications to build revenue-generating products and increase profit margins. Let’s review a few.

A prime example of using connected car data to offer new products is usage-based insurance (UBI). Usage-based insurance solutions collect vehicle telematics data to measure speeding, acceleration, and harsh braking, along with mileage and trip time. Then, based on this collated information, they come up with a person’s driving score that insurers use to calculate premiums.

UBI has become increasingly popular among insurers and drivers as an efficient, transparent solution that drives positive customer engagement. Indeed, a TransUnion survey conducted in 2022 found that 40 percent of respondents were offered a telematics program (up from 32 percent in November 2021). Moreover, out of this group, 65 percent joined, up from 49 percent over the same period.

The data-based vehicle insurance trend is gaining traction, and savvy insurance companies seek innovative ways to embrace it. For example, they forge partnerships with car manufacturers to access data from driver assistance systems and car platforms.

Examples of such alliances include Daimler Insurance Services and Swiss Re working together to build digital mobility solutions or Generali Italia and Fiat Chrysler partnering to develop personalized insurance for connected cars. Other organizations, like Bâloise Group, make their portfolio of data-driven products based on transformative digital solutions, like Motion-S’s mobility platform.

The concept of usage-based insurance is fairly easy to grasp. Still, several terms are worth explaining to get the whole spectrum of insurance products deriving from UBI and leveraging modern telematics.

This insurance type relies heavily on telematics, analyzing each driver’s patterns and behavior to determine the policy rates. Actions such as braking and gently accelerating are measured and factored into renewal calculations, helping customers achieve affordable rates as they drive safely and responsibly.

Pay as you drive (also known as pay as you use or pay per mile) auto insurance helps drivers get the most convenient rates based on their driving habits. However, unlike pay how you drive, it focuses more on the mileage covered rather than the driver’s skills. The insurance rate is calculated based on the distance driven in a given period, which benefits customers who drive occasionally rather than regularly.

Also known as ‘hourly insurance’ or ‘pay as you go’, this model measures a person’s hours behind the wheel, tailoring premiums accordingly. In this extremely flexible model, customers can get instant car insurance for as few as 1-2 hours, precisely when needed.

This type of auto insurance uses a blackbox device to track and record a policyholder’s driving behavior. The goal is to base the insureds’ premiums on how much they drive and how safe (or risky) they are behind the wheel.

When I changed my car and went on websites to try and find cheaper insurance, you get a different outcome depending on how you tweak your employment or your wage. This is quite negative because people who are on higher incomes or have a more professional job get [cheaper] insurance than people on a lower wage, which is quite disturbing.

An insurance customer with financial vulnerability

[Source: ABI UK]

In a world where rewards are handed out almost everywhere, insurance companies also have tools to create positive customer experiences. For example, insurers can reward clients for not being involved in an accident or renewing a policy. They can also implement a rewards points program based on driver safety data. Namely, driving safe for a week could result in a set number of points; this could be broken down further into things like no excessive braking, speeding, cornering at appropriate speeds, being mindful of the weather, and driving safely during harsh conditions.

And it needs no mentioning that generating driver buy-in by an insurance company can increase its profits. Drivers naturally want to be safe, but a push from the insurance company in the form of a reward might be what they need to achieve it. And safer driving equals less loss on the bottom line for the insurance company; therefore, on a large scale, the cost of driver safety rewards will greatly improve the amount of savings, translating into bigger profit margins.

Overall, rewards programs based on data help insurers regularly engage with their customers and cut accident rates. At the same time, they are an effective tool for building customer loyalty. No wonder industry leaders such as Aviva, Zurich, or RSA use data-driven rewards plans to motivate drivers to stay safe.

Motor insurance industry is reinventing itself. To participate, incumbent players will need to conduct a thorough analysis of future mobility trends. Building partnerships with various players in the mobility sector could also help players develop convincing value propositions for future customers, as could participating in developing new mobility ecosystem offerings. Whichever route they take, today’s insurers must be part of the industry’s reinvention if they are to remain relevant.

Rebecca Beckert

Associate partner at McKinsey

[Source: McKinsey]

Going green is all the rage these days, and for a good reason. Creating policies to promote a cleaner world is a great way to shed a positive light on one’s company, attracting new customers and reinforcing loyalty from existing customers. Discounts for Hybrid/Electric vehicles and alternative fuels (biodiesel, electricity, natural gas, hydrogen, or ethanol), as well as Pay as You Drive (PAYD) programs, have been gaining popularity in the insurance industry. All promote a more sustainable drive style, and when coupled with telematics, can multiply the benefit to sustainability.

Based on augmented trip data, data-driven telematics solutions calculate scores and metrics on fuel consumption estimation, eco score, and EV (Electric Vehicle) score:

Based on these scores, insurers can provide tips and suggestions (for example, using an entertaining mobile game) to drivers to reduce their carbon footprint and lower gas use by improving their driving habits, routes, and vehicle selection. Modern insurance telematics can also provide meaningful insights into car wear, helping car owners extend their vehicles’ longevity.

Profiling driver behaviors and designing appropriate pricing models are essential for auto insurance companies to gain profits and attract customers. However, traditional methods of assessing risks are inefficient. This is where data analytics comes into the picture.

Knowing that the human factor is the chief reason causing the accidents, insurers have long looked into drivers´ profiles to provide discounts on insurance premiums. However, standard driver profiling methods leave much to be desired regarding accuracy. Typically, they are based only on gravitational force changes and the count of input usage. Incidents are recorded when a g-force threshold is met during Acceleration, Braking, and Cornering, known as the ABC analytics (sometimes speed is incorporated too, ABCS analytics) or frequently used pedal presses.

The problem is that numerous actions that may trigger a telematics gravitational force threshold would be considered ‘normal driving’ by many and may not increase the likelihood of an accident. In some situations, it may be the preferred way of driving safely. Therefore, we need to fully account for more factors to understand the risks involved in driving behaviors.

Based on the driving patterns, disjoint clusters are identified that group drivers according to common behaviors while still accounting for individual differences. Driving style clustering then provides the basis for more precise driver coaching. With the telemetry of each trip, insurers can investigate specific incidents to capture both transient behaviors and habitual driving styles. This telemetry-based information can then provide contextual suggestions to drivers on how to drive safer and more efficiently. And more data than in traditional systems means more coaching available, which can equate to better driving in more situations, which eventually leads to the end goal – fewer claims and fewer incidents.

As a result of using video-based driver coaching, ArcBest (a freight transport company with almost 7,000 drivers) has seen a 13% reduction in preventable accidents. Fewer accidents, of course, equals less loss. Coaching for a driver safety discount can be seen as an exciting opportunity.

Distracted driving, excessive speed, running red lights, drunk driving, and unsafe lane changes are among the top causes of car accidents regardless of the country. These behaviors endanger millions of drivers, passengers, and traffic participants each year, claiming thousands of lives. They also directly relate to the number and value of driving accident claims, impacting the profitability of individual insurers and the automobile liability insurance market on the whole.

By collecting driver data enhanced with detailed insights about the car, weather, surroundings, and other factors, insurers can identify the areas of highest risk specific to a particular driver. Modern telematics combined with AI-driven mobility platforms provide the full context of each road event, allowing them to analyze individuals for bad driving habits, risky or aggressive road behaviors, distracted driving, seat belt usage, and so on. Using that knowledge, insurers can coach individuals efficiently on safer driving to mitigate risks and lower the chances of submitting claims.

Finally, tapping into vast volumes of connected car data enables insurers to sell more. We all know the power of Netflix or Amazon recommendations and how efficient they are in keeping consumers involved. Data-driven mobility analytics uses a similar principle to empower insurers to sell more products and services. An accurate assessment of a policyholder’s profile makes it possible to anticipate customer needs and suggest broadening their existing scope of services according to what has been found based on data.

Additionally, blending mobility analytics with chatbots, dynamic dashboards, or interactive mobile apps can inspire new, innovative products and services that strengthen customers’ incentive to buy insurance products. For example, a self-service app is an efficient medium to inform customers about their available product options and promote cross-sell by aggregating diverse products and information. For example, a client with only car insurance may see a personalized suggestion for health insurance in the app and ask for a quote, or vice versa.

Chapter Five

A successful, sustainable, connected insurance program cannot exist without three things: responsiveness to the evolving consumer needs and wants, integration of modern, data-driven technologies, and data. Seeing how car data analytics translates into cost efficiency and higher returns, there’s no doubt that connected car insurance is a game-changer for providers. But while its benefits are evident, a question remains about how to integrate connected car data into your services to realize them.

One

From plug-ins and onboard diagnostics (OBDs) to dash cams and mobile phones, there are several types of telematics devices you can use to power your connected car insurance offering. In principle, they all work by collecting car data and sending it for analysis. However, each device has its pros and cons and specific uses.

For example, mobile-based telematics will be the most suitable for standard insureds. It can feed data straight into a user-facing loyalty and rewards application, a driver coaching game, etc. Black boxes make sense when you want to introduce mileage-based insurance. They will also be a good choice for high-risk or young drivers. Fleet insurance programs often use OBD dongles.

Learn more about the most common types of telematics devices in our article “Selecting the right telematics device or data collection solution”.

Two

Detailed, contextual knowledge of insureds and their driving style powers highly-personalized products and services that translate into increased customer retention. But to take advantage of it, insurers need user data. Lots of it.

Meanwhile, obtaining user information is often the trickiest part of the connected insurance program implementation. While in general, consumers are becoming more willing to share their personal data with providers, most of them still need a strong incentive to do so.

That is why setting the tracking permissions needs to be simple and as non-invasive as possible. Users can’t feel like they are being tracked. Instead, they should feel as if they were playing a fun game on an ongoing basis. Gamification (badges, challenges, scoreboards, rankings) will help maximize their engagement, encourage regular interactions, and improve driving skills. Another motivating and efficient tool is badges, which truly give people a sense of pride in themselves. They also positively reinforce good behaviors and endorse driver accomplishments.

Your customers can redeem reward points as in-game currency or use them to purchase products and get discounts. To offer these possibilities, consider teaming up with major retailers.

Your customers could also use the points to purchase a ticket to a cinema or get a discount coupon for a buy one, get one free food offer. Other rewards include rental- and garage-related discounts, travel vouchers, and technology-related discounts. A partner program can also feature discounts on insurance products as rewards (e.g., on policy renewal, deductible, or other insurance products).

With detailed driver data at your fingertips, you can also launch specific challenges to keep your customers entertained. For example, think about starting a green driving week, rewarding users who improve their driving style to achieve a 20 percent reduction in emissions. Or challenge the drivers not to touch their phones while on the road. Think of these little tasks as a means to break bad driving habits in a more targeted, fun way.

For fleet insurance, you normally want to tie games and point collection to a good policy discount and coaching drivers, as the benefit is really for the fleet owner. For the drivers, building employee bonuses and rewards for safe driving conduct could help with engagement, too.

Three

In order to accurately and fairly rate each driver, you need to evaluate their information in a given context. After all, overspeeding on an empty road during the day, with perfect visibility, and great road conditions is not the same as doing so in heavy rain at peak traffic.

Developing a meaningful safety score to inform your insurance products, rates, and discounts, relies on numerous factors. Some of them, like speeding, accelerating, complying, or resting, directly relate to the driver (driver behavior). Others, including road conditions and topology, the weather, or the trip time, provide the much-needed context essential for calculating personalized, exact risk scores. Only by tying all these data points together can you get an accurate picture of each trip to correctly estimate premium rates and offer personalized insurance products.

Four

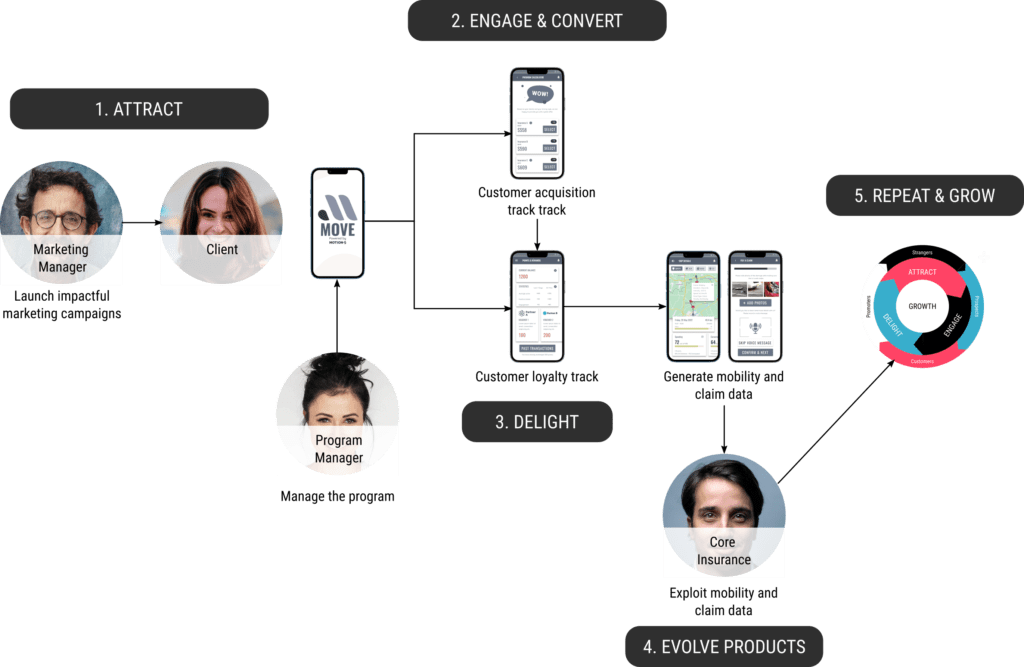

When correctly implemented, a connected car insurance program will cater to all stages of the customer journey:

It unites the entire organization around the idea of innovating and amazing customers. Therefore, all stakeholders must be on board with it. Spread awareness, endorse your program, and ensure everyone understands its advantages for you and your clients. Explain to your teams how the new program will support them at work, making it easier to meet their targets. Here’s an example: A program manager can easily see and optimize sales conversion or loyalty and rewards products using insights from connected cars. On the other hand, the strategist team gains in-depth knowledge of the risk exposures, claims, and products.

The full picture: whom to involve and what to do.

Five

Building a new insurance product is not just a marketing effort. Nor is it a one-off exercise! The start of this journey with a new, innovative product begins with customers’ unmet needs but remember that these needs are constantly evolving. As is the data that feeds the connected car insurance.

Due to that, a resilient connected insurance program requires constant testing, experimenting, and optimization. Have you added a new data source? Great, think about how you can leverage it to tweak your driver coaching program for insureds. Does a new partnership opportunity arise? Think how you could integrate it with your existing discounts and rewards for an enticing yet consistent offer. Have you identified risky behavior consistently across your pool of users? Make sure you launch a driving challenge that addresses said behavior to raise awareness and coach drivers in a fun way.

Chapter Six

Customer engagement isn’t the only area to reexamine by motor insurers. Rapid technological progress forces the auto industry to keep pace, and successful insurers must go at the same speed. Here’s an outline of some major technology trends that can change the insurance game in the short and long term.

Considering the massive increase of LTE and 5G network coverage, the rise of low-earth orbit satellites, and the ubiquity of near-field communication like Bluetooth or Wi-Fi, it is only logical that connected cars are the future. So much so that Statista predicts that by 2030, the share of new cars shipped with in-built connectivity will reach 96%. Leveraging these trends are connected car platforms that bring together complex, multi-source vehicle and driver data to provide homogeneous data points across car models and brands in a way that can be consumed by mobility analytics platforms and connected insurance solutions.

Connected cars generate live data from the vehicle’s electronic control units (ECUs), Controller Access Networks (CANs), and infotainment systems, including diagnostic trouble codes (DTCs), ADAS activation, fuel levels, battery status, AC consumption, vehicle locations, maintenance status, and many more. All information is then made available to third parties via API, allowing Mobility Analytics companies to create various innovative solutions covering use cases such as connected fleet management, car post-sales management, and maintenance follow-ups for garages, among others. For the specific case of insurance providers, connected cars are expected to unlock new possibilities for launching Connected Insurance programs without the need for external telematics devices and based on uncontested data transmitted directly from the car.

Predictive analytics is a particular use case of the AI application, which does not provide insights into past events, but instead helps prevent certain situations by predicting future outcomes. It can be applied not only to reduce the number of collisions and accidents, but also to prevent insurance fraud or streamline claims triage.

The rapid rise of car-sharing and ride-sharing gave birth to on-demand insurance specific to a single trip, not so much to a particular driver. This possibility is invaluable to drivers who also use their vehicles for ride-sharing services such as Uber or Lyft to avoid potential liabilities during a trip that their traditional policy may not cover. Car-sharing policies, on the other hand, apply to models such as peer-to-peer car sharing and lending and car clubs. In these applications, determining who was driving a car during an accident or collision is essential. AI-based mobility solutions help establish that and determine the cause of the event.

118 million people use Uber or Uber Eats once a month

In 2021, Uber had over five million drivers worldwide

Uber services are available in over 900 cities globally

Uber drivers completed 6.3 billion trips in 2021 or an average of 17.4 million per day

Quarterly, Lyft has 12.5 million active riders

As of 2022, Lyft has over two million drivers

Despite our ambitious hopes for a driverless 2020 future, self-driving cars are not yet there. Moreover, some analysts specializing in self-driving technologies debate if they will ever come to fruition. For now, we have barely reached level 2 of autonomous driving (out of six in total), with no clear sign of transiting to the next stage.

Nevertheless, as tests continue worldwide, insurers must keep driverless cars at the back of their head, especially as authorities in some countries (like the UK) have already set the stage for their future arrival, mandating compulsory insurance plans for autonomous vehicles.

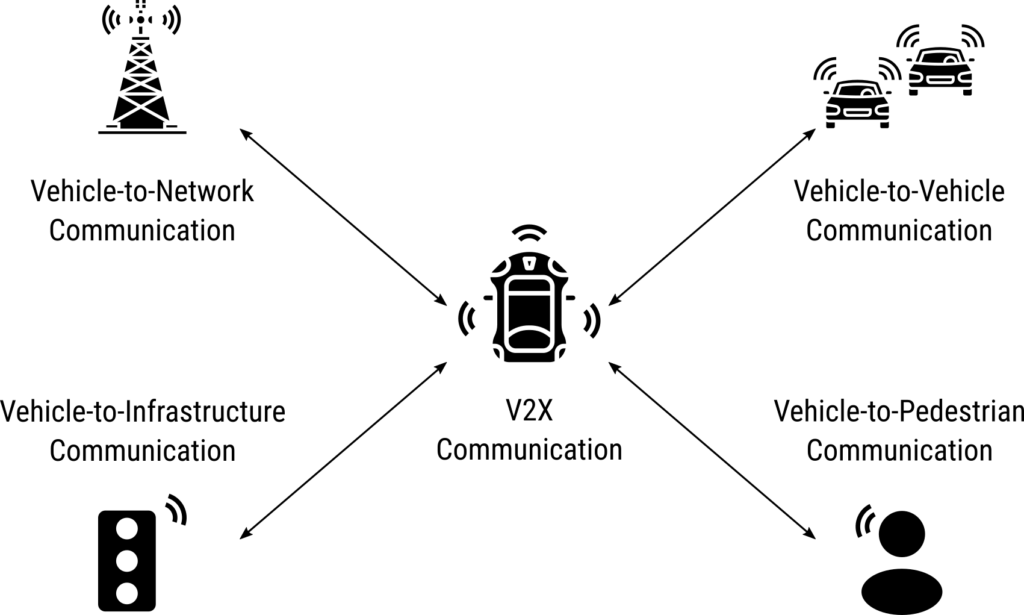

It is also worth noting that V2X (vehicle-to-everything) communication is progressing. The ability to communicate among vehicles is already here (vehicle-to-vehicle, or V2V). Modern cars often come with sensors that alert drivers of a kid or a dog about to pass the road or notify them about people and objects entering the blind spot (vehicle-to-pedestrian, or V2P). Vehicles can also access mobile-network operators’ LTE, 5G infrastructure, and DSRC systems as if they were mobile devices (vehicle-to-network, V2N).

How will all of that affect motor insurance? For example, developments in vehicle-to-infrastructure technology (V2I) aim at providing a 360-degree analysis of the car’s surroundings, notifying the drivers of a potential crash. This will translate to drastically reducing the number of accidents. Pedestrians and cyclists can use V2P solutions to get push-up notifications about approaching vehicles, contributing to road safety. Finally, “knowing” destinations and predicted behavior of other cars can improve the driver’s efficiency.

I don’t think you can order a car, pick you up from your house, take you to work until probably 2050.

Kelly Funkhouser

Manager Vehicle Technology, Consumer Reports

[Source: CBS News]

V2X Communication

Chapter Seven

The global motor insurance market is currently valued at $777 billion as of 2022. Within the next five years, it is expected to grow at a CAGR of 3.9%. Giants like Allianz, General Motors, and AXA are pushing their investments in Asia and Africa to snatch the biggest possible share of that pie. But even for smaller companies without multi-continental expansion plans (or, maybe, especially for them), remaining profitable in overcrowded European and American markets can be extremely challenging.

Differentiating one’s offer from thousands of competitors calls for a new approach to motor insurance products, services, and customer engagement. In this context, connected insurance programs are gaining attention and traction since they open the way for affordable, accessible, and personalized insurance products aligned with modern consumers’ expectations:

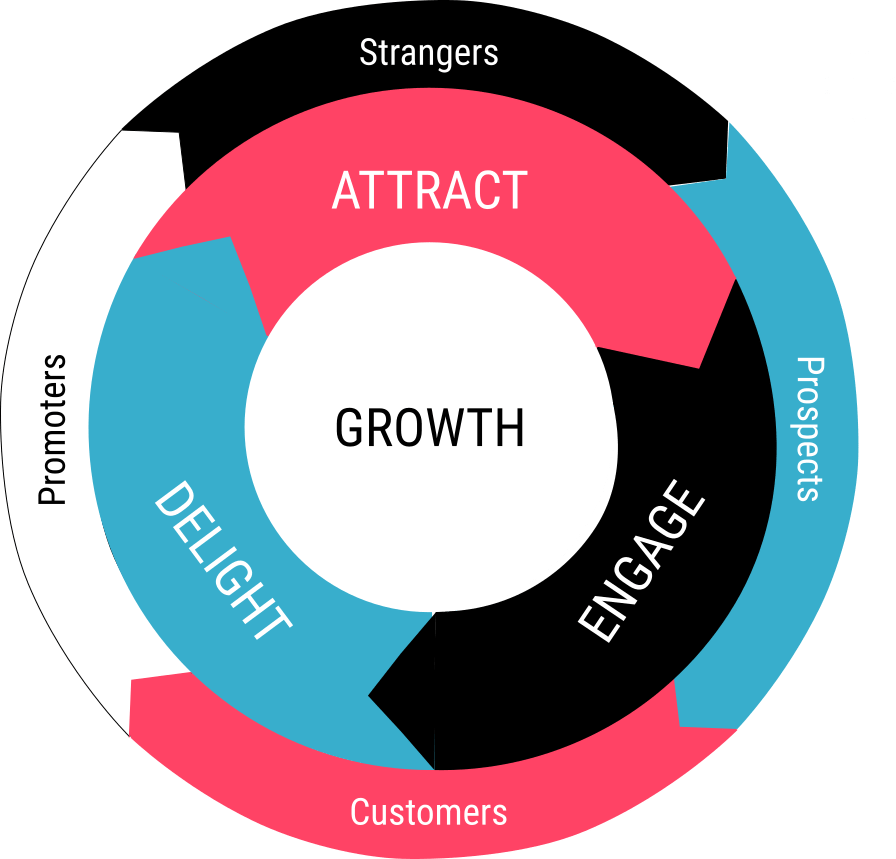

A simple conclusion emerges from the above trends: insurance customers want a choice, a voice, and an impeccable experience. A well-designed insurance program can give them exactly that. It attracts new insureds with tailored offerings and pricing, sustains their engagement with personalization, and makes them ambassadors of the brand through products and services that enhance loyalty.

Still, a question persists: “How to build an effective connected insurance program to achieve these objectives?”.

It seems that several aspects determine the chances of success:

When designing a connected insurance program, getting all those points right will help you stand out with your offering and carve out a niche in the crowded car insurance market. And if you aren’t sure where to start, we are ready to support you.

Final Thoughts

Embrace the impact of data-driven mobility solutions

Do you feel it’s the right time to innovate your car insurance offering? Are you looking to implement a reliable solution that will allow you to take advantage of AI and data abilities to prioritize customer experience?

Get in touch with our experts, who will advise you on what technology you may implement to gain detailed knowledge about your drivers and match your products with their evolving expectations.

Did you like what you read? Share it!

Are you ready to start your connected insurance program?

Get a head start on your connected insurance strategy! Reach out to us to discuss your use cases and needs, or sign up for a FREE demo. See how impactful insights can improve your chances of success!

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

What Is Connected Car Insurance?

How Telematics Helps Reduce Claims And Fatalities

Launching Connected Insurance Programs To Accelerate Business Growth

Building A Successful Connected Car Insurance Program: Essential Steps

Embracing Future-Forward Insurance Trends

Connected Insurance Programs – The Next Age In Motor Insurance

Would you like to see our solutions in action? Check our calendar and find the perfect slot suiting your schedule!

Test drive our API Suite for 30 days!

Tell us a bit about yourself, and we’ll get in touch with you in no time.