Creating a Connected Insurance Program That Finally Works

A practical guide for car insurers to build customer-engaging products, expand services, and boost profitability in the post-pandemic times.

… Read More

Road accidents are one of the major public health threats globally, and the human factor is the main contributing force. To account for this fact, insurers have long applied harsh acceleration, braking, and cornering (ABC) events to analyze driver behavior and inform their pricing models. However, this method has some limitations. Telematics-based contextual driving behavior analytics surpasses them, giving insurers and fleet operators a much better way to evaluate risks posed by individual drivers.

A few years ago, the US National Highway Transportation Safety Administration conducted a study that concluded 94% to 96% of all auto accidents are credited to human error. These results submit evidence that an individual’s driving behavior primarily impacts the likelihood and severity of an accident. Safe drivers are involved in fewer accidents, and the severity decreases when they are.

Knowing that the human factor is attributed to be the chief reason causing the accidents, insurers have for the past decade looked into drivers´ profiles to provide discounts on insurance premiums. However, standard driver profiling methods leave a lot to be desired regarding accuracy. Typically, they are based only on gravitational force changes and count of input usage. This means that incidents are recorded when a g-force threshold is met during Acceleration, Braking, and Cornering, known as the ABC analytics (sometimes speed is incorporated too, ABCS analytics) or frequently used pedal presses.

The problem is, there is no correlation offered to accident risk or claims from standard telematics-based technologies, which should be the primary element for measuring driver safety. Numerous actions that may trigger a telematics gravitational force threshold would be considered ‘normal driving’ by many and may not increase the likelihood of an accident at all. In some situations, it may be the preferred way of driving safely. Therefore, many more factors need to be considered to truly understand the risks involved in driving behaviors.

For example, accelerating quickly on a highway ramp would be safer than accelerating slowly and attempting to merge into the traffic flow at a slower speed. The discrepancy in speed between the merging vehicle and those around it increases the chance of an accident. In a standard ABCS analytic system, a driver could be penalized for accelerating too quickly, especially if they had to take an outdated or poorly designed ramp regularly, even though in this situation, it would be the safer way to drive.

The same can go for braking. It would be safer to hit the brakes a little harder on the off-ramp than to start slowing down on the highway when coming across a shorter than normal off-ramp. Also, coming up on a pedestrian crosswalk or school zone can create excessive braking, multiple brake hits, or drag braking, which all could cause issues in a standard telematics system. Traditional systems that factor in speed only look at vehicle speed and speed limit. No – or few – other factors are accounted for, like road layout, conditions, signage, topology, and weather conditions, all of which can greatly change how to drive properly.

Meanwhile, poor road conditions can increase stopping distance and diminish the life of suspension components. Road signs are there for a reason, but drivers overlook or ignore many of them, which creates a greater risk of accidents, especially in animal crossings. Finally, driving in fog or rain can greatly reduce visibility, and slower speeds should be observed to drive safely. With the ability to track weather conditions, driver profiles would be much more accurate.

Drivers taking this junction have a little over 100 meters to speed and merge, all while others attempt to get over to get off the highway simultaneously. Not an easy task to do all this and keep from accelerating fast, coming on, braking hard, getting off, and going through the sharp turns without exceeding the g-force limit. If you take this route daily, it may greatly diminish your ability to be considered a safe driver.

Risk factors need to be seen in their context, where the event happens. In rural, urban, and freeways environments, each risk factor can contribute differently to accident risk and eventually claim costs. Therefore, driver profiles should account for the distance traveled on different road types, the observed risk factors per road type and the estimated distance traveled per year. Matching these results with recent road accident statistics will enable car insurers to weigh risk exposure correctly, coach drivers through positive rewards, and reduce accidents accordingly. But how can they do it? The answer is contextual driving risk analysis enabled by data-driven telematics.

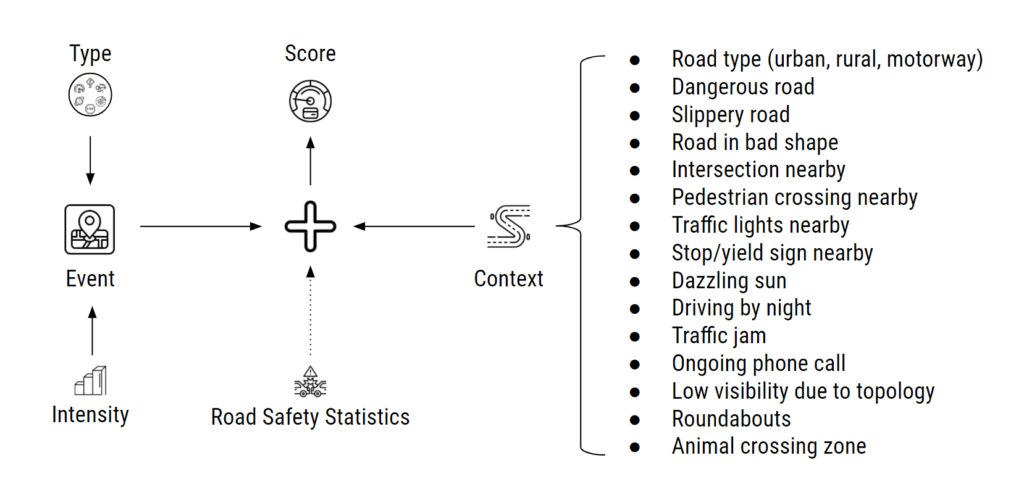

Telematic-based driver profiling is a multifactor upgrade of acceleration, braking, cornering, and speed analytics (ABCS) that leverages scientific data analytics to offer a much-improved process to calculate reliable and objective risk scores. It comprises a variety of base risk factors deriving from different categories that augment the driver behavior assessment with the context of driving. These factors, including traffic lights, slippery and dangerous roads, traffic jams, or ongoing phone calls, help accurately quantify the risk exposure of having an accident.

With better and more data in place, modern data-driven telematics systems are more accurate and efficient in preventing accidents than their predecessors. As a result, these solutions are also much more precise when calculating reliable and objective risk scores. By factoring in more realistic scenarios with these systems, insurers can gather specific data to verify each driver’s habits.

Additionally, ABCS systems may cause some frustration by negatively rating a driver for what’s considered ‘bad driving’ but makes more sense in a given situation. Or encouraging driving behaviors that in real-life situations wouldn’t be the correct choice, but a driver only looking for the highest score would possibly choose because the system requires that. A contextual driving risk analysis system, on the other hand, removes the driver’s ability to trick the system and greatly reduces false triggers during situational driving.

Driving style, where, when, and under which conditions one is driving, impacts the risk of having an accident. Modern data-based analytics incorporates telematics data comprising a range of base risk factors to assess driving profiles realistically.

Modern insurance telematics can also be used to create a dependable sustainable driving assessment or provide meaningful insights into car wear. Thus, running models and algorithms over augmented data, profiles can be delivered per trip, driver, and vehicle to enhance and inspire innovative insurance products.

For example, a data-driven telematics platform can calculate scores and metrics on fuel consumption estimation, eco score, and EV (Electric Vehicle) score based on augmented trip data. These scores can inform various loyalty programs that reward customers for driving green. Insurers can also extend the program to other parameters, such as safe driving or avoiding overspeeding. Finally, grouping drivers showing similar behaviors into clusters can provide the basis for a precise driver coaching, including contextual suggestions on how to drive safer and more efficiently.

Key Takeaway: As the number of cars worldwide increases, so does the number of accidents. A body of research indicates that human error is the main culprit. While the existing ABCS analytics systems have proven insufficient to investigate the risks involved in driving behavior, sophisticated, data-based vehicle telematics platforms provide essential insights that help reward and promote safer driving styles. On top of contributing to the reduction of car accidents, they allow auto insurance companies to optimize their profits by reducing the number and severity of claims and launching new, innovative products and reward programs likely to attract and retain more customers.

A practical guide for car insurers to build customer-engaging products, expand services, and boost profitability in the post-pandemic times.

… Read More

Are you ready for a new era of device-free, data-driven Fleet Solutions?

Watch our free webinar to look at the future of #fleetOptimization powered by Connected Car Data. Together with our partner High Mobility, we’ll be looking at the new possibilities that open up thanks to Connected Car Data and how these can empower innovation across the fleet industry. We’ll cover: “What use cases do OEM-connected car data platforms enable?”, “What are its current limitations, and how to tackle them?”, “What to expect of the midterm future?”, and “How connected car data can be leveraged to innovate in the fleet industry?”, among others. Register now and join the discussion.

… Read More

Traditionally, connected insurance uses data from IoT telematics devices to tailor premiums based on driving insights. But today, new ways of building effective connected insurance programs have come into play, like driver safety rewards programs, sustainability and green benefit programs, personalized recommendations, or cross-selling insurance products. To tap into these, insurers must deploy appropriate data collection technology. But what is ‘appropriate’ in this context? … Read More

There are many immediate benefits to launching a connected insurance program—from higher customer engagement and loyalty with rewards, coaching, and reduced claims, to new revenue streams thanks to innovative insurance products. But the jackpot, truly, lies in the long-term vision. To maintain profitability in the long haul, motor insurance companies should already think two steps ahead, reconsidering their data approach today to reap benefits tomorrow. … Read More

The car insurance industry has seen many conversations around the pivotal role of digital technologies, product innovation, and customer-centricity as market differentiators. With these concepts, new terms have emerged to reflect the cutting-edge technologies and the upgraded ways of doing business. Understanding what they mean, how they differ, and what opportunities and constraints they entail, is essential to getting ahead of competitors.

… Read More

“Any sufficiently advanced technology is indistinguishable from magic.” The best-known technology law formulated by Sir Arthur C. Clark in the ’60s still holds today, when insurance companies can use connected telematics solutions as a competitive lever to improve profitability and expand their customer base. To better understand how that works, we’ll take a step back and examine how telematics has changed over time. … Read More

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Test drive our API Suite for 30 days!

Tell us a bit about yourself, and we’ll get in touch with you in no time.